Great Tips About How To Reduce Audit Risk

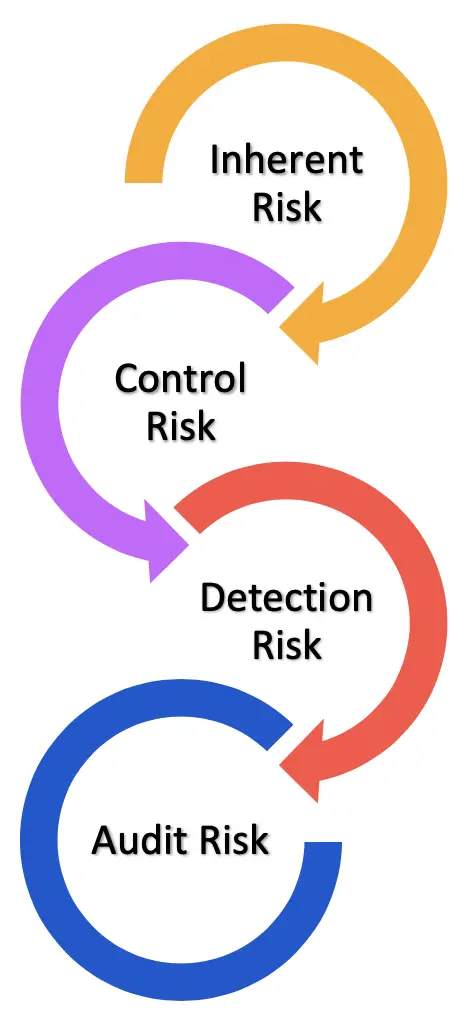

Audit risk is the risk that an auditor concludes an incorrect audit opinion about your business’ financial statements.

How to reduce audit risk. 6 ways to reduce your chance of an irs audit! However, when it comes to avoiding tax audits from claiming r&d tax credits, you’ll want to follow these specific tips: A risk assessment starts by deciding what is in scope of the assessment.

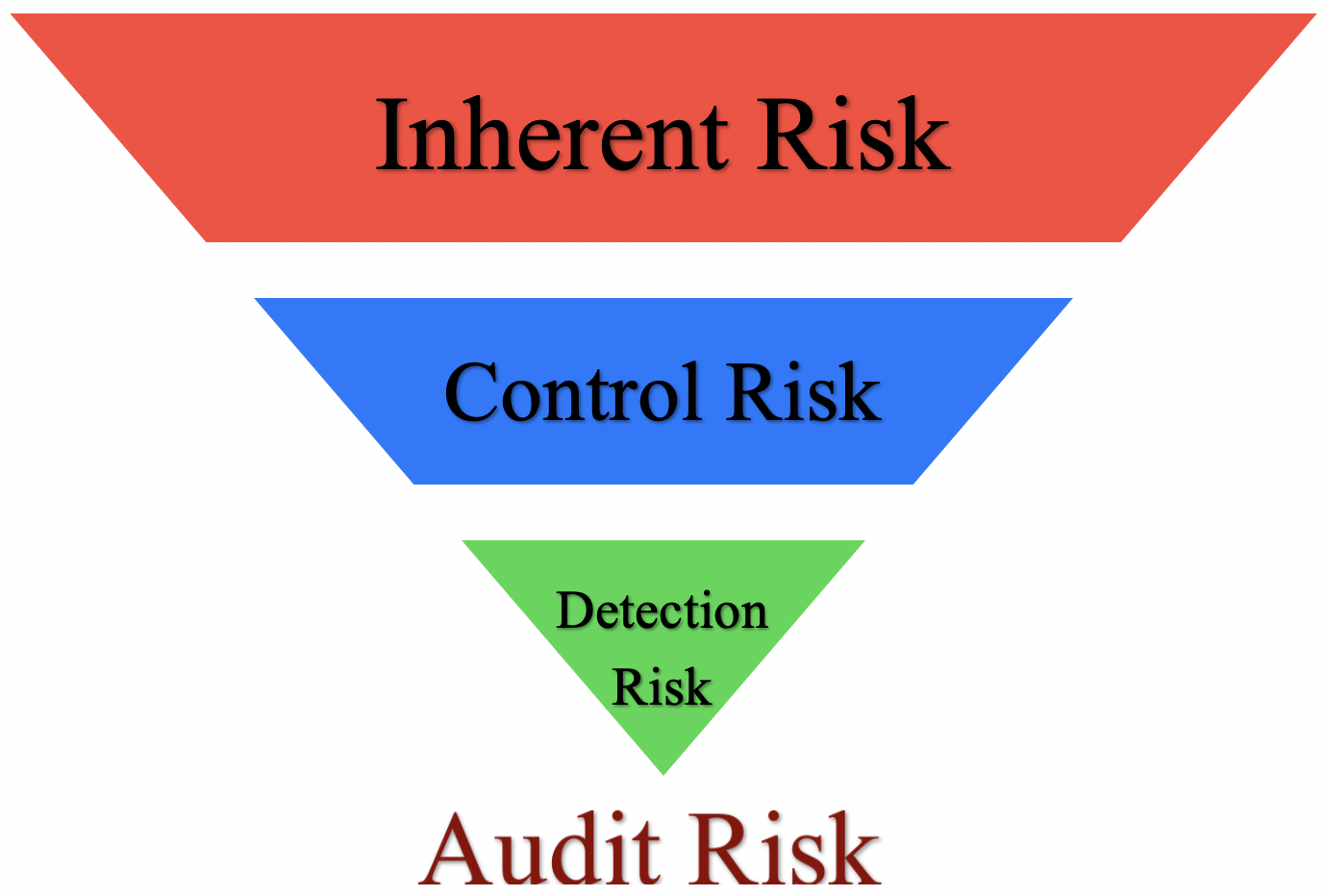

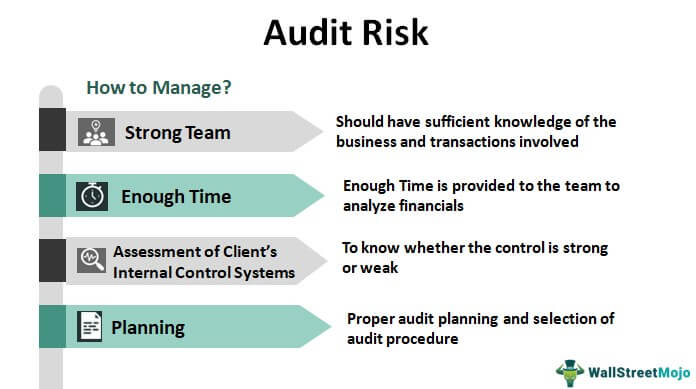

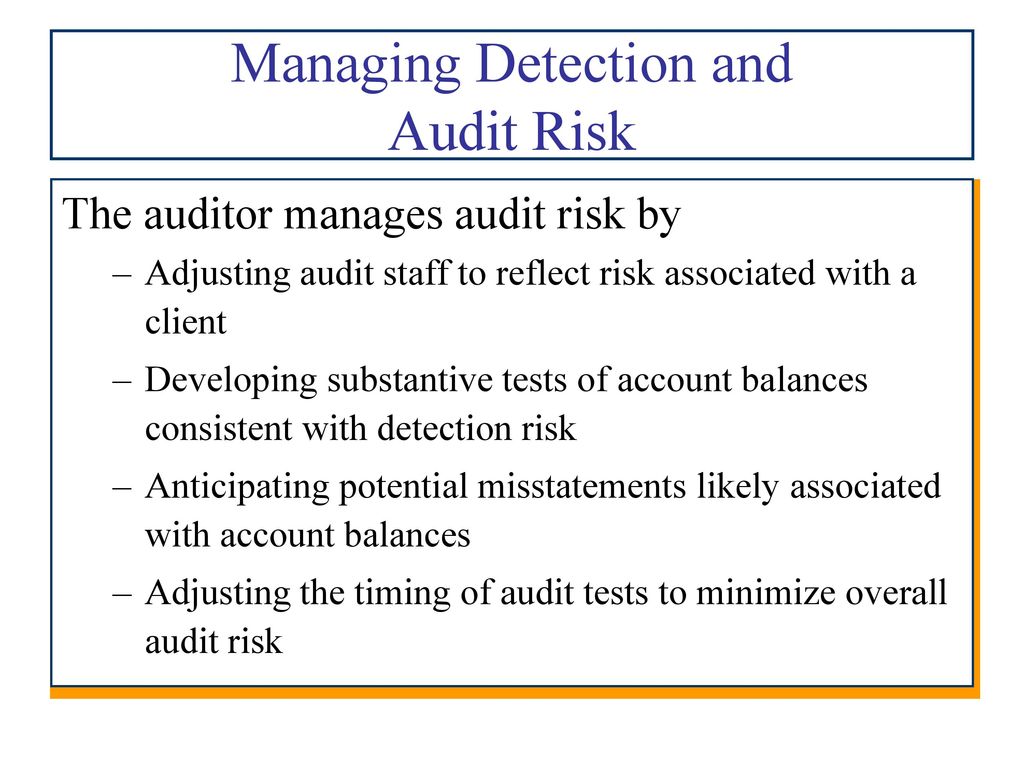

One of the best ways to limit audit risk is to utilise the audit risk model. Not surprisingly, people with incomes of less than $25,000 have a much lower risk than millionaires of being audited. This is the risk that the procedures performed by the auditor to reduce audit risk to an acceptably low level will not detect a misstatement that exists and that could be material, either.

Audit procedures designed to specifically address the risk of material misstatement: You've probably already figured out that as a business owner your odds of getting audited by the irs are much higher than they'd be if you. Monitoring key processes and controls senior.

If you have little income and do get audited, you can find a. The irs computer system may flag your tax return if your “deduction to income” ratio is unusually. When carrying out audit procedures relevant to testing assertions, there needs to be a special focus.

Assign the task of reviewing. In addition, the cra has strategies for. It could be the entire organization, but this is usually too big an.

How to reduce risk efficiently & meet your audit needs. Building off #2, sufficient time should be allocated to properly plan the audit. Verify that your activities are qualified.

Up to 10% cash back leverage internal audit management software. This can be because of detection risk or. Have the proper control objectives/criteria been included in the audit.

Determine the scope of the risk assessment. As we’ve mentioned throughout, there are ways to reduce business risk without slowing your project. Keep all contractual agreements and pharmacy provider manuals in a central location.

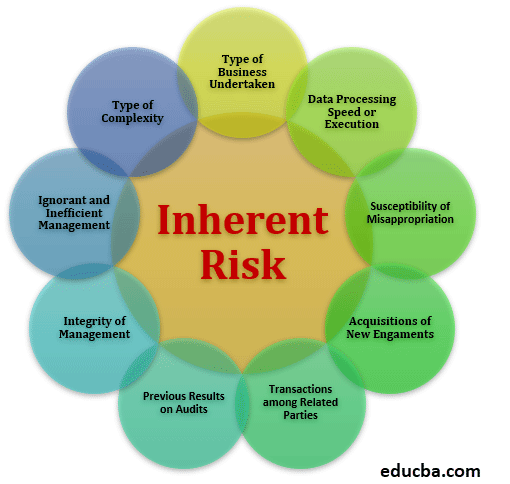

Internal auditors can mitigate ransomware risk by leveraging internal audit management software. In order to help organisations identify the problems that may arise in their audits, the model divides the. Internal auditors can identify where fraud risk exists and make recommendations to adequately mitigate such risks.